Food exports to China

Despite economic growth and increasing production opportunities China’s demand on goods exported by foreign companies is going up. Firstly, the conditions of living in China are improving, which is reflected in increasing disposable income of Chinese citizens who get better opportunities to spend more. Secondly, PRC stimulates value-added services development, prioritising to support innovation sector and technologies, whereas agriculture is still an high-demanded area that is available for foreign agriculture business products.

Other reasons are related to the fact that PRC's agricultural sector can not esure total food safety, therefore China like many other countries importers in the field of agriculture has to be an importer of agricultural goods of different categories, which is one of the largest markets for any exporting company specializing in these export categories. For example, it is related to fish, meat and various food additives export in China, the increasing demand on which is supported by the changes in food intake of Chinese people. In this brief country commercial guide we will tell you about China's position in food import and main features of organizing food export to China.

Content

Top imported products in China’s market

How to export food products in China: key issues

Online channels of selling and promotion in China

Top imported products in China’s market

Food import determinants: parameters of internal consumption in China

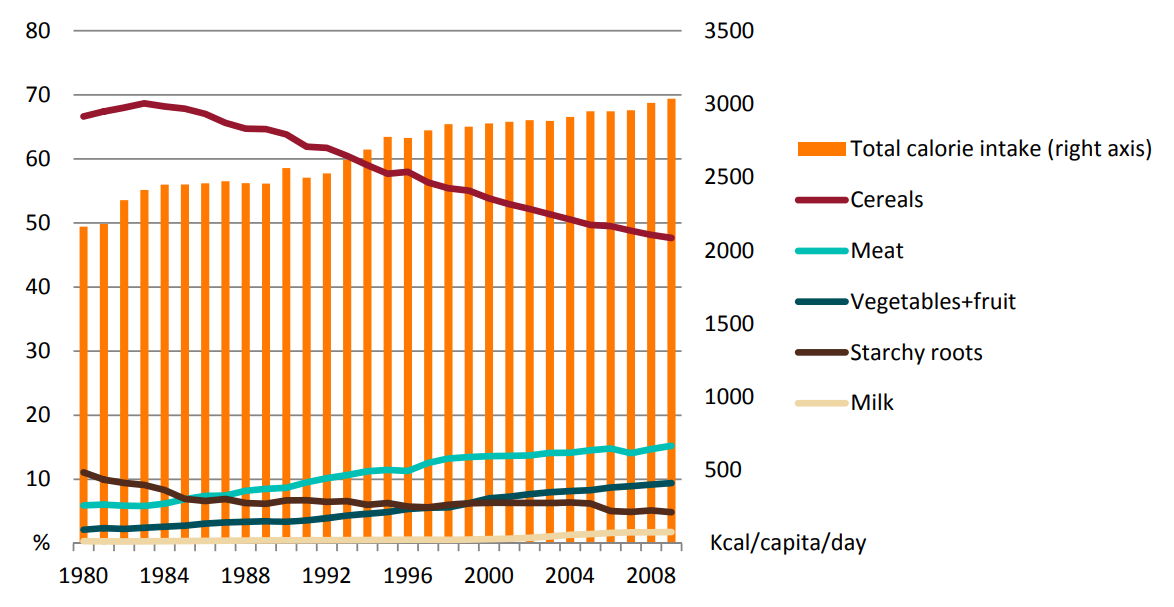

We should primarily note the changes in Chinese people’ consumption patterns. First, in the conditions of economic growth and increasing standards of living Chinese consumers demand on food products is growing. It reflects an increase of total calorie intake that has started after the beginning of the Reform and Openness policy.

Then, it is easy to detect changes in demand on different categories of agricultural commodities. For instance, China’s citizens have started to decrease buying a food subject like cereals which were the basis of dietary intake. On the contrary, they started to prefer purchasing more meat products.

Calorie consumption by source in China between the late XIX and early XX centuries

Despite demographic problems, the Chinese government continues to put emphasis on supporting consumption growth that is reflected also in the official documents of the 14th Five Year plan.

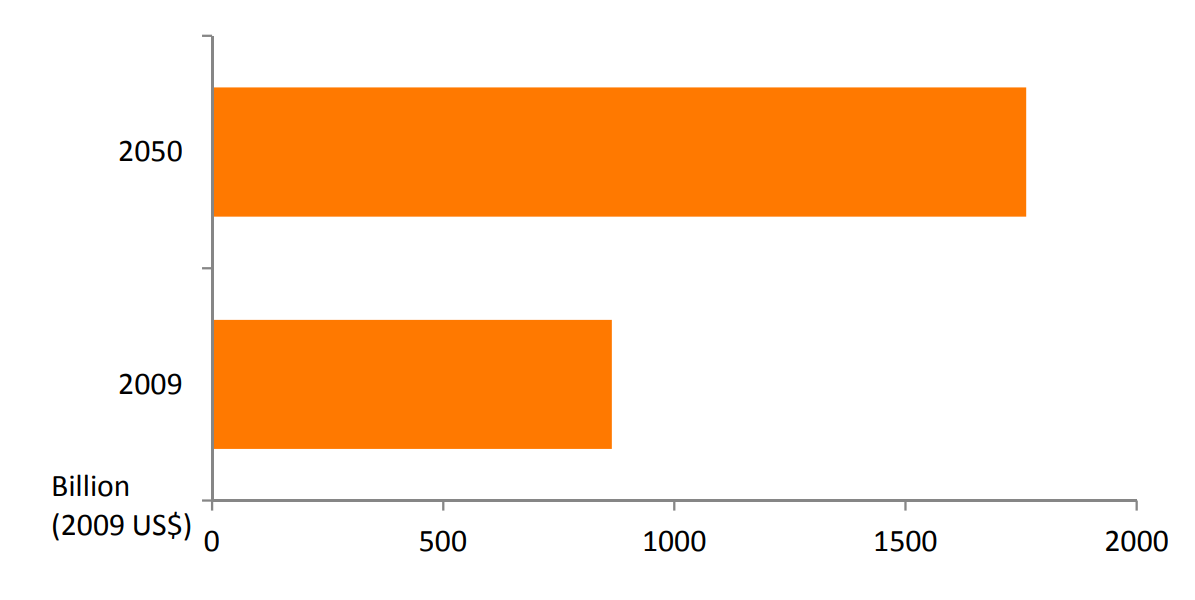

Forecast of total agrifood consumption in China by 2050

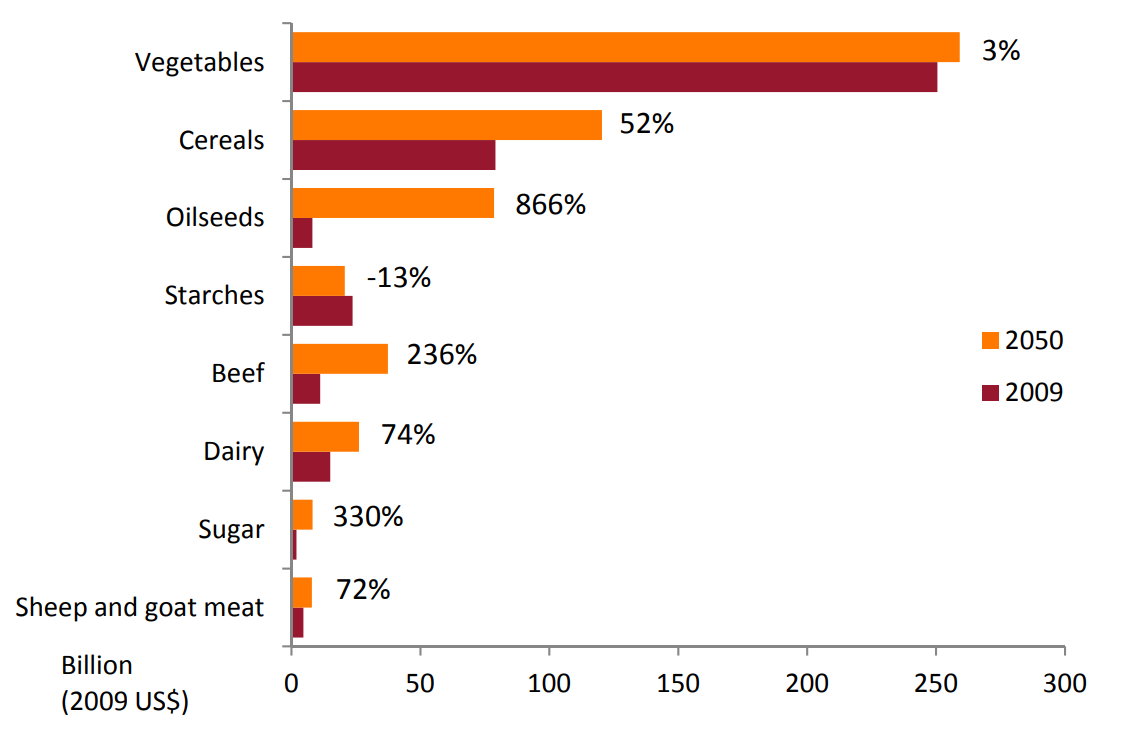

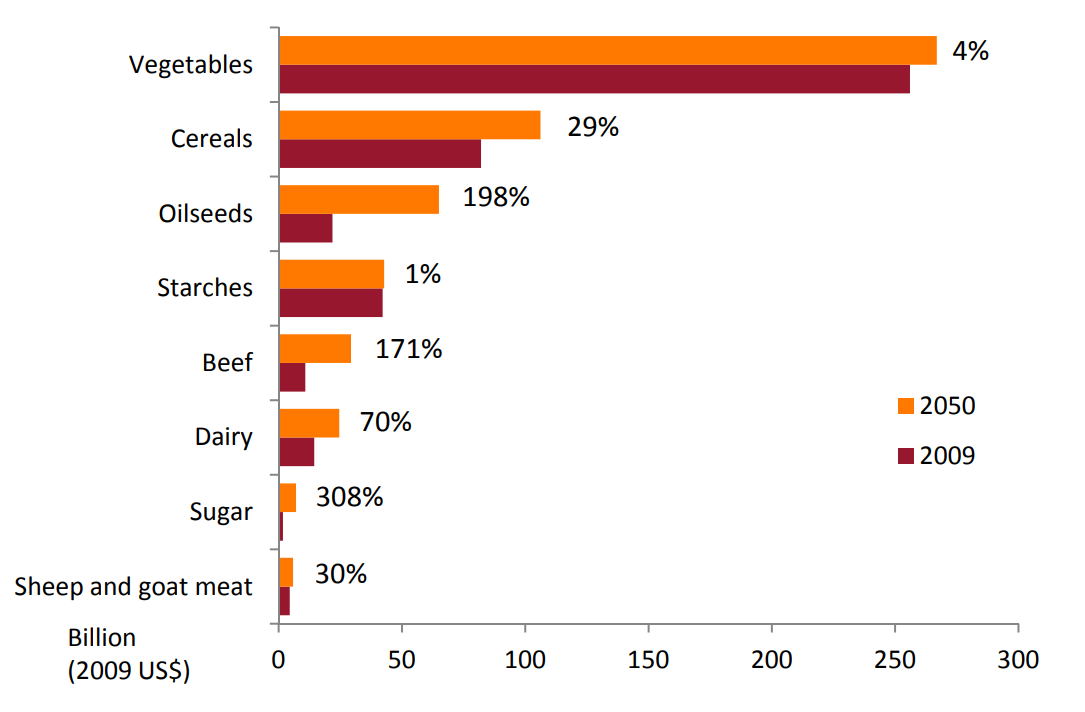

Besides, it is necessary to say that China is one of the largest producers of agricultural goods in the world. However, internal production can not satisfy growing demand. For instance, according to ABARES estimations, despite a large growth of beef and other categories of meat consumption in China (236% and 72% correspondingly), an increase in production is predicted to be only 171% and 30% that is a good long-run opportunity for foreign agriculture companies and a stimulus for foreign companies to expand goods exports to China.

Forecast of total agrifood consumption in China by 2050

Forecast of production of selected food commodities in China by 2050

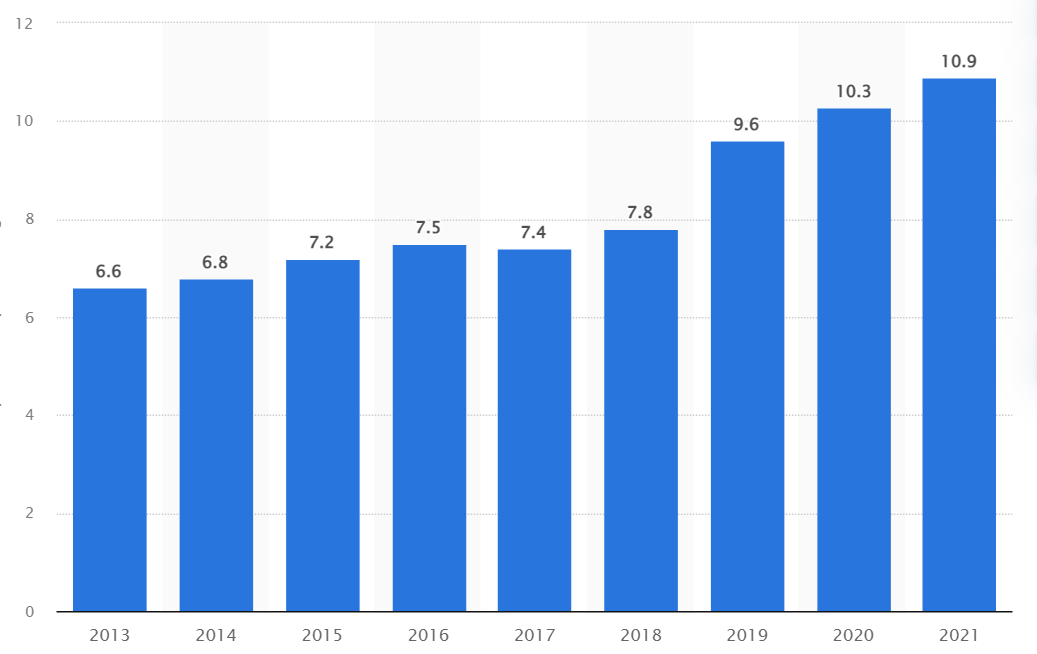

As for fish and other seafood consumption, we can also notice a positive trend. According to Statista, average consumption of seafood was about 6,6 kilograms per capita in 2013 and grew up to 10,9 kilograms by 2021. At the same time, the retail market in this category of agriculture by revenue in China was about $75 billion in 2021, it is estimated the market size will reach $120 billion by 2027 that depicts a good perspective for trade with China in this direction and fish export to China’s market.

Seafood consumption in China (kilo per capita) in rural areas from 2013 to 2021

Top imported product categories in China

Chinese import: general review

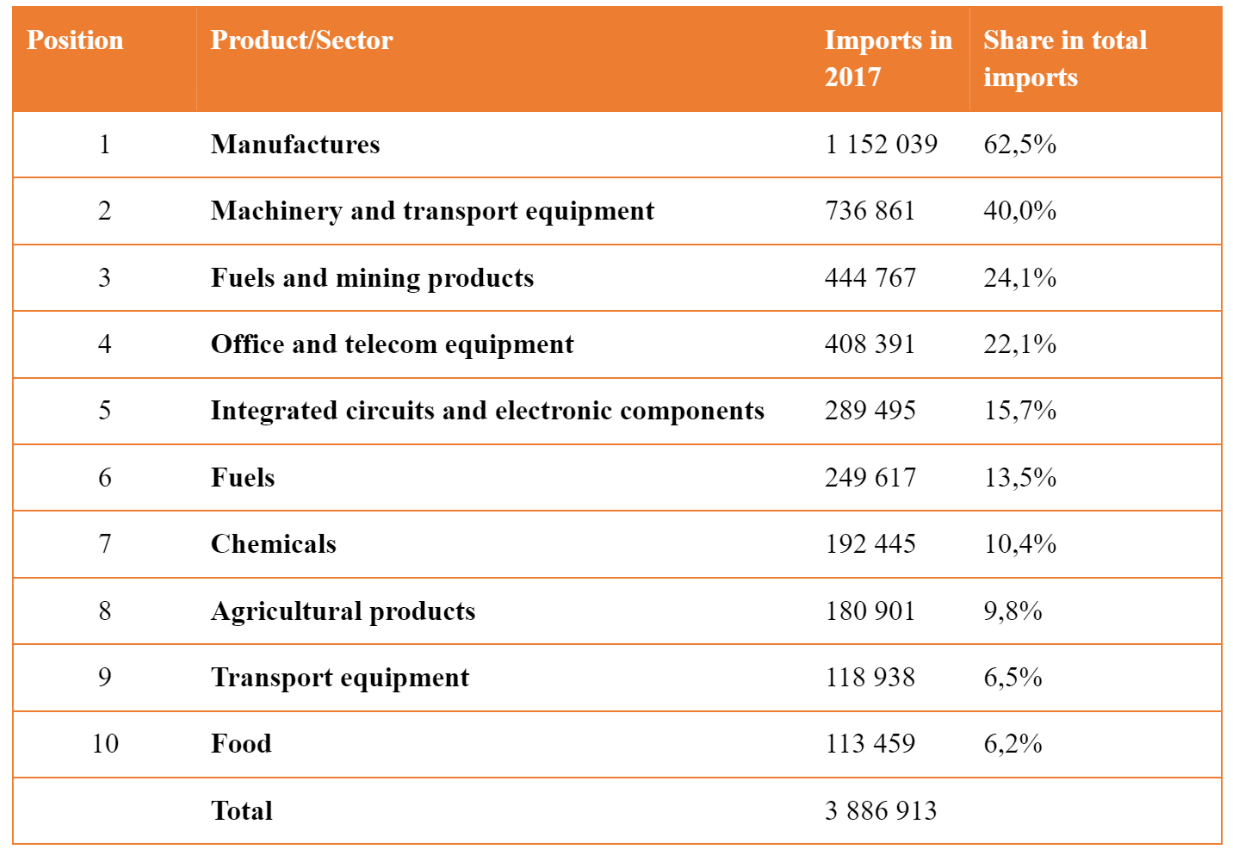

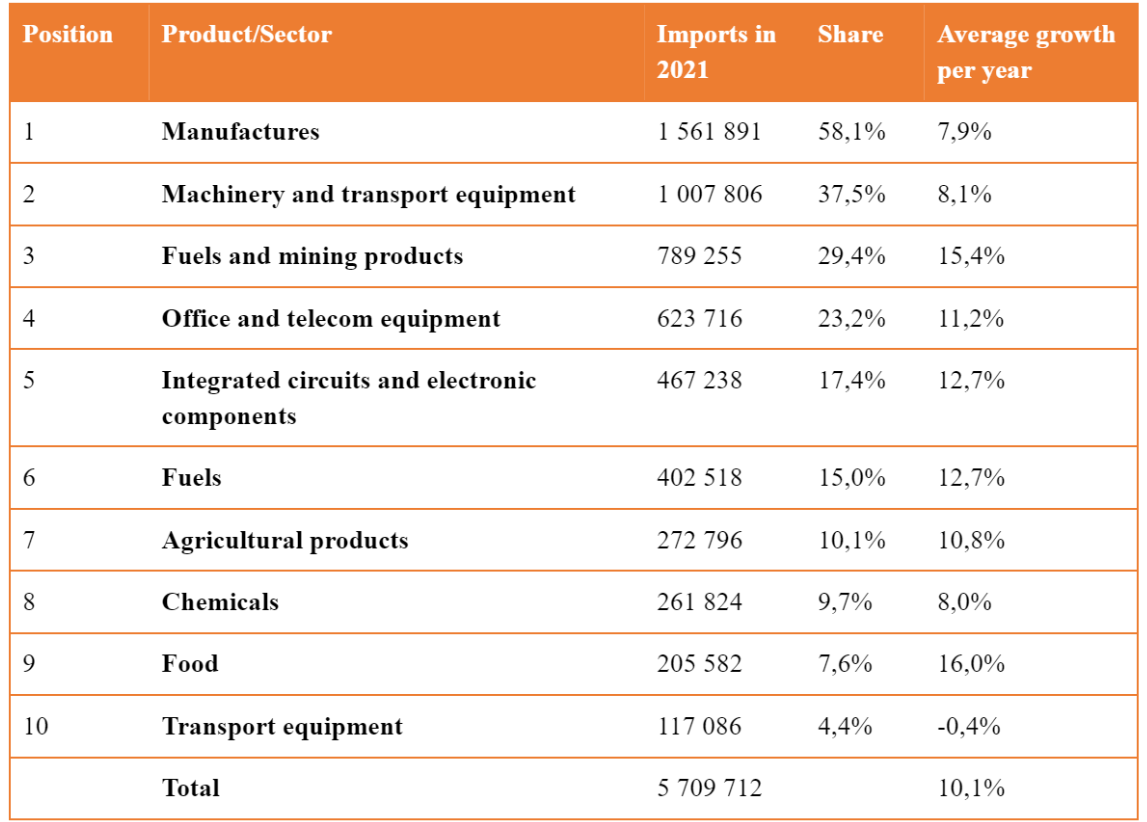

First, speaking about China’s imports, it is easy to notice that China has been increasing imports of different categories. As we can see from the tables below, China’s economy depends on manufacturing imports and energy resources, which have the largest share in total China’s imports. However, food and agriculture products continue to be in the top 10 categories of China’s imported products.

Regarding average growth of some import categories we can receive a more detailed review. For instance, the average rate of import growth in the “Food” subject was the largest (16%) among other top categories in 2017-2021. This fact means there is an increasing interest of Chinese consumers in food imports that is a prospective direction for foreign exporting companies.

Main categories of Chinese imports in 2017 (in million dollars)

Main categories of Chinese imports in 2021 (in million dollars) and average growth in 2017-2021

Fish and meat products import in China

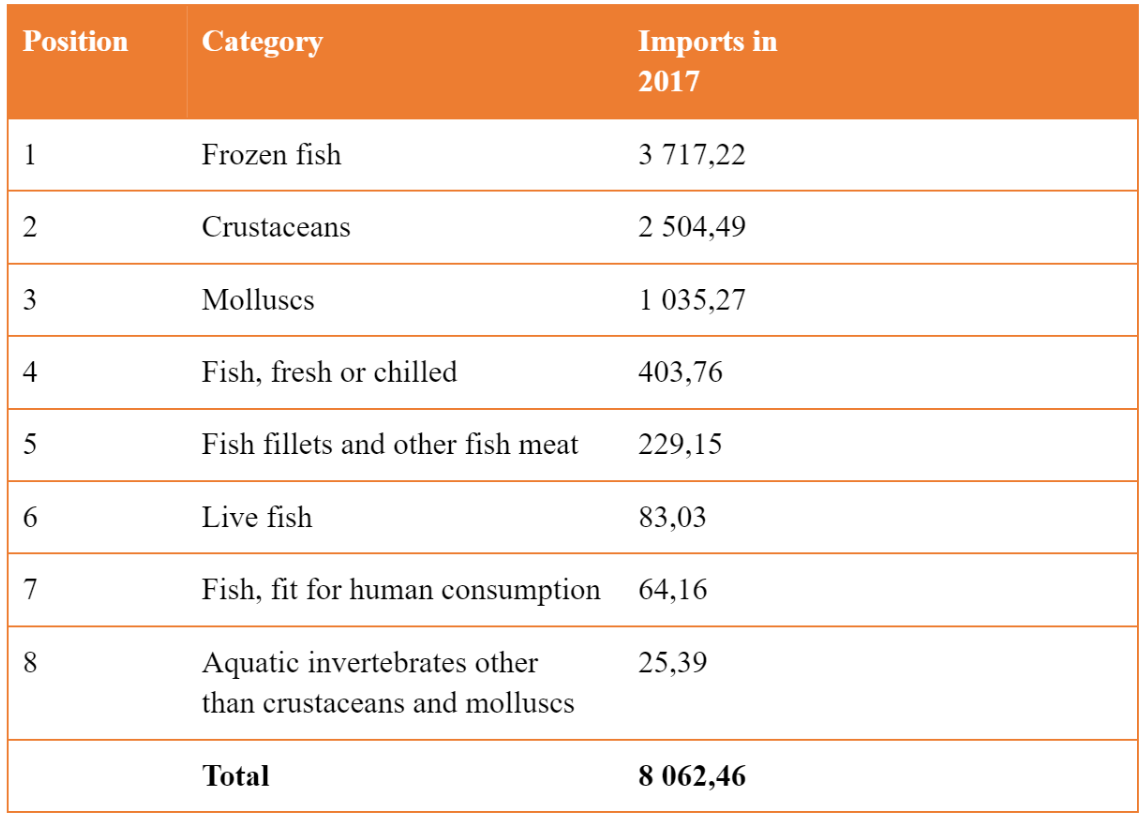

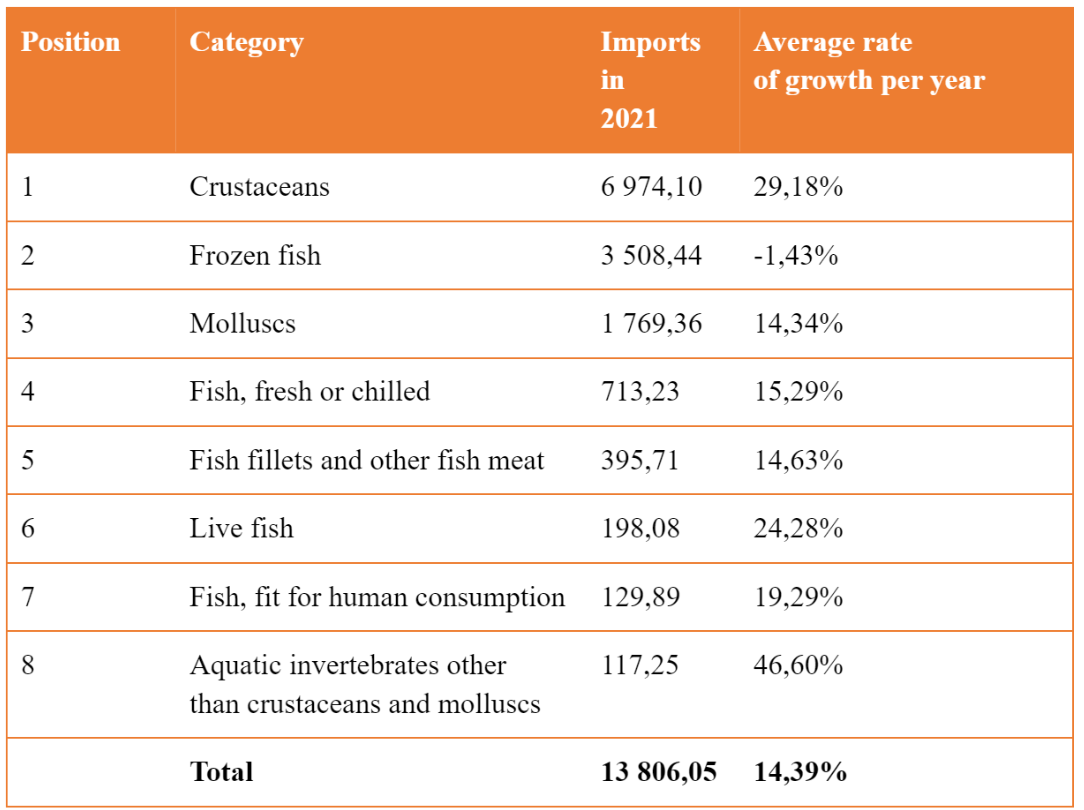

Regarding fish and other seafood imports in China, we can find a positive trend: average rate of fish and other seafood import growth was about 14,39%. However, there is a differentiation in growth of product categories in this list presented in the tables below.

As for fish imports, China’s consumers are more interested in live fish and fish that is prepared for consumption, whereas the amount of imported frozen fish has decreased in recent years. At the same time, China’s consumers increased demand on other seafood categories like crustaceans, became the largest imported product in seafood import, and other aquatic invertebrates, average growth of which were 29,18% and 46,6% respectively.

Main imported categories of fish and other seafood in China in 2017 (in million dollars)

Main categories of fish and other seafood import in China in 2021 (in million dollars) and average growth in 2017-2021

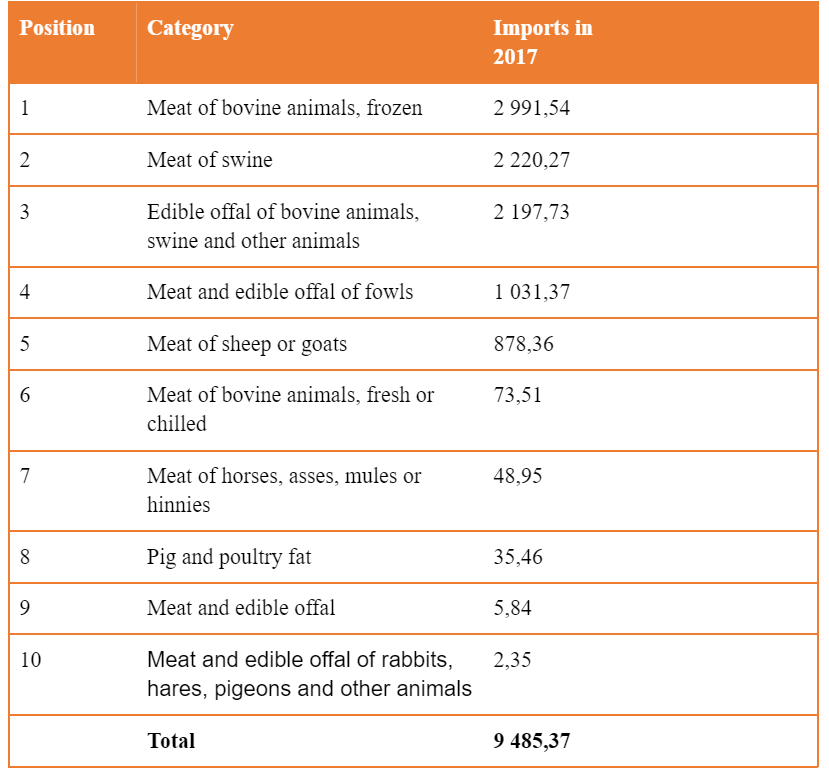

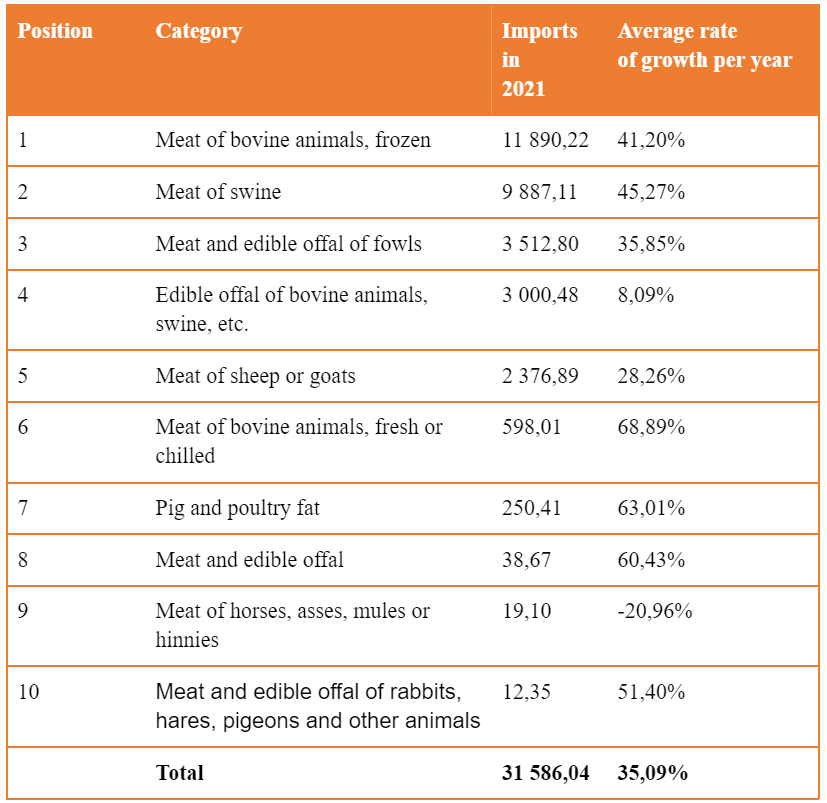

Speaking about meat imports we should put emphasis on the following features. First of all, China’s consumers create a large demand on bovine animal meat used for further processing and food preparations (average growth is 41,2%), but extremely popular has also been bovine animal meat prepared for consumption (fresh or chilled) with the largest average rate of growth (68,89%). This fact reflects growing disposable incomes of China’s citizens and increasing demand on more expensive meat related to bovine animals. Thus, a company that is going to export beef products and cattle meat could become a successful exporter on China’s market.

Then, such a subject as pork commonly used in China’s traditional cuisine continues to be a popular product. Total imports of pork has increased intensively in recent years: average growth in 2017-2021 was about 45,27%. Besides, we can observe active growth of other categories of exports to China related to offals and fat that are used in China’s cuisine, special dietary uses and food production industry.

Main categories of meat import in China in 2017

Main imported categories of meat in China in 2021 (in million dollars) and average growth in 2017-2021

How to export food products in China: key issues

After analyzing the Chinese market and doing research you should prepare for passing some necessary steps related to Chinese customs, China’s export requirements and China’s export and import regulations. We described briefly the main features you undoubtedly should consider and China’s general administration defying future trade conditions and regulations in China.

Registration in AQSIQ

If you are confident that there are no restrictions to export your products in Chinese market, then it is necessary to pass the registration in AQSIQ to ensure that you are able to do goods trade such as services exports and commodities exports to China. This is China's government special department that controls and validate an imported products' certificate to ensure that they correspond to China’s standards.

There are a group of documents that are necessary to submit an application to register in the AQSIQ department system. For instance, you need to attach information about your company business, export certificate, information about the products you export and other documents. You can visit the AQSIQ website and check the following documents.

Pre-import license

Some categories of products need to be provided with pre-import licenses. For instance, it relates to some groups of products like dairy or poultry. AIL license can be accompanied with additional needs you should regard, the China’s Ministry of Commerce website can help you to determine if you need the document or not. However, a majority of imported products in China can be exported without a pre-import license.

Trademark

One of the most important issues you should primarily consider is your trademark in China. First, you should know about the “territoriality” principle that means that foreign trademarks abroad are not relevant in China’s jurisdiction and it is necessary to register it in the country. Then, China’s trade dealers often use the “first-to-file” regime that means whoever first submits an application to register a trademark afterwards receives a right to obtain it.

Besides, China’s dealers can implement other ways to steal your intellectual property. For instance, if you register your trademark only written in Latin characters, your competitors can use Chinese characters to register an analogue of your brand’s trademark. Thus, try to register a trademark in both variants.

There are two approaches to register a trademark in China including registration via China’s Trademark Administration and World intellectual property organization. However, before that you should make sure that there are no submitted applications related to your trademark, it is possible to check on the website.

Labeling

Before shipment check carefully labeling requirements, your product must comply with the GB standards referred to Guo Biao (国标) - China’s national standards. There are different rules you should know, for example GB7718-2011 regulating pre packaged food labelling, etc. You can check necessary rules on the website.

As a whole, there are some basic rules that should be followed, such as:

Name of your commodity

Information about producer and distributor

Date of production

Weight

Country of manufacturing and sending

AQSIQ registration number

Storage instruction details, etc.

Inspection by CIQ

The main task of CIQ department staff is checking that your goods labeling satisfies China’s regulations and standards and contains a full range of shipping documents.

You can face some challenges at this stage. If there are no needed documents, then your commodities can be removed or sent back. In case you deal with the confiscation problem, you should either require a CIQ declaration or submit necessary documents.

Online channels of selling and promotion in China

E-commerce sites

Earlier the only way for companies from foreign countries to sell your products in China was finding local Chinese importers and China’s distributors could help to sell food products in the country. Nowadays, there are a lot of new ways of exporting commodities in China through online channels including e-commerce platforms without finding a direct Chinese importer. The most popular ones include marketplaces needed to obtain China’s business license to sell in China, for instance, retail trade platforms like Pinduoduo or Tmall, and wholesale trade sites like 1688.com.

China’s marketplaces are becoming more and more popular sites for purchasing a majority of product categories. For example, about 30% of total retail sales in China was related to e-commerce sites in 2020 before the COVID-19 started. Chinese marketplaces are a comfortable commercial service for both sellers, obtaining different options like monitoring market statistics and tracking purposes, and buyers using such a type of commercial service to simplify shopping without a need to contact a seller directly. Besides, having access to selling on China’s marketplaces means that your business activity is verified, it ensures you can earn the trust of China’s consumers.

There are also marketplaces giving access for exporters to enter China's market without a China’s business license, the most popular ones are Tmall Global, JD Worldwide, and Kaola. Working with such marketplaces lets exporters simplify selling in China not only by limited requirements, but also by highly developed logistical services. For instance, Alibaba Group being an owner of Taobao and Tmall ensures a common logistics and supply chain operated by Cainiao that is integrated also into Tmall Global. Using online marketplaces make it easier for Chinese customers to purchase imported products from other countries without typical transborder issues like customs procedures or automatic import license.

Advertising and social media

Today, traditional advertising channels are becoming less effective, therefore you should put emphasis on promotion in leading China’s social media that is a significant part of each country commercial guide related to China.

First, you can consider launching banners and targeted ads that are available in all main promotion channels such as China’s marketplaces, Baidu apps or WeChat.

Besides, you should communicate with China’s audience in popular social media making your brand more popular in China. Therefore developing a subscription account in WeChat or creating blogs, for example, in Zhihu or Baidu Zhidao are crucially important to communicate with your targeted audience to popularize your brand in China.

If you have a Chinese website, you also can implement SEO campaigns, for instance, with assistance of Baidu apps it is possible to improve its range and increase organic traffic.

If you represent an exporting company, and you are interested in marketing research of China’s food product market and promotion of your goods in China, contact us and we will help you to develop a promotion strategy in PRC and join a group of successful exporters in the Chinese market.

SIMILAR ARTICLES

Tell us about your Project

TURKEY, ISTANBUL

Сaferağa Mah.General Asim Gündüz Cad.no:62 iç kapı no:5 kadıköy / İstanbul / turkey

Tel.:+90 (534) 215 69 76

About us

The team of China Digital Marketing Agency offers all-round marketing and online brand promotion in China.

Meet us Chinese version Site mapSERVICES:

DEVELOPMENT

Website Mobile apps ICP license Hosting in China Domain registration in ChinaSMM

Promotion on social media WeChat Weibo Douyin Youku BilibiliCONSULTING

Marketing Research in ChinaAdvertising in Baidu

Contextual advertising SEO promotionChinese tourists

Infrastructure preparation and attracting tourists from ChinaMini programs in WeChat

Development, design and promotion Enabling WeChat Pay Enabling AlipayContacts

We process your applications 24/7.

© 2018-2024 China Digital Marketing Agency Terms of Use | Privacy Policy